A Complete Guide to Investing with Impact

Introduction

In a world where financial systems often prioritize profits over people, social finance emerges as a transformative approach that bridges the gap between money and social good. But what exactly is social finance, and how does it work?

This comprehensive guide will explore:

✅ The definition of social finance

✅ How it differs from traditional finance

✅ Key models and examples

✅ Benefits and challenges

✅ The future of social finance

By the end, you’ll understand how this growing movement is reshaping investments to create a more equitable and sustainable world.

What is Social Finance?

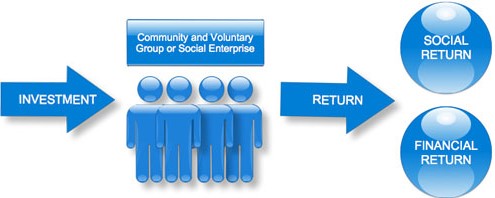

Social finance refers to investments that generate both financial returns and positive social or environmental impact. Unlike traditional finance, which focuses solely on profit, social finance aligns capital with ethical values—supporting initiatives like affordable housing, clean energy, education, and healthcare.

Key Characteristics of Social Finance:

- Dual Objectives: Balances financial returns with measurable social impact.

- Innovative Models: Uses tools like impact investing, social bonds, and community funding.

- Stakeholder Focus: Benefits investors, communities, and the planet.

This approach is gaining traction as more investors seek ethical, sustainable, and purpose-driven opportunities.

How Social Finance Differs from Traditional Finance

| Aspect | Traditional Finance | Social Finance |

|---|---|---|

| Primary Goal | Profit maximization | Profit + Social Impact |

| Investor Mindset | Short-term gains | Long-term sustainability |

| Risk Assessment | Financial risk only | Financial + Social risk |

| Examples | Stocks, Hedge Funds | Green Bonds, Microfinance |

While traditional finance prioritizes shareholder returns, social finance considers broader stakeholders, including underserved communities and the environment.

Key Models of Social Finance

1. Impact Investing

Investing in businesses or funds that deliver measurable social benefits alongside financial returns.

- Example: A venture capital firm funding a startup that provides solar energy to rural areas.

2. Social Bonds

Debt instruments where proceeds fund projects with social benefits (e.g., education, healthcare).

- Example: The World Bank’s “Sustainable Development Bonds.”

3. Community Investing

Directing capital to underserved communities through credit unions or community banks.

- Example: Kiva’s microloans for small entrepreneurs in developing countries.

4. ESG Investing (Environmental, Social, Governance)

Incorporating ethical criteria into investment decisions.

- Example: Investing in companies with strong labor practices and low carbon footprints.

5. Pay-for-Success Models (Social Impact Bonds)

Investors fund social programs and earn returns based on successful outcomes.

- Example: A bond funding job training programs, with returns tied to employment rates.

Benefits of Social Finance

✔ Positive Social & Environmental Impact

Supports causes like poverty alleviation, climate action, and gender equality.

✔ Attracts Ethical Investors

Millennials and Gen Z prefer investments that align with their values.

✔ Long-Term Financial Stability

Sustainable businesses often perform better over time.

✔ Encourages Innovation

Funds startups solving global challenges (e.g., renewable energy, healthcare tech).

Challenges & Criticisms

❌ Measuring Impact is Complex

Unlike profits, social benefits can be hard to quantify.

❌ Lower Short-Term Returns

Some impact investments may yield less than traditional markets.

❌ Greenwashing Risks

Some companies falsely claim social impact for marketing.

❌ Limited Liquidity

Social investments may have longer lock-in periods.

Real-World Examples of Social Finance

🌍 The Rise of Green Bonds

Corporations and governments issue green bonds to fund eco-friendly projects. In 2023, global green bond issuance reached $500 billion.

💡 Microfinance: Empowering Entrepreneurs

Grameen Bank (founded by Nobel winner Muhammad Yunus) provides small loans to low-income entrepreneurs, lifting millions out of poverty.

🏠 Affordable Housing Investments

Funds like the Community Reinvestment Fund (CRF) finance affordable housing projects in underserved U.S. neighborhoods.

The Future of Social Finance

As awareness grows, social finance is expected to expand in:

- Blockchain & DeFi – Transparent, decentralized impact investing.

- Corporate Social Responsibility (CSR) – More companies adopting sustainable funding.

- Government Policies – Tax incentives for social investments.

Experts predict the global impact investing market could surpass $1 trillion by 2027.

How You Can Get Involved

- Start Small – Invest in ESG funds or crowdfunding platforms.

- Research – Look for certified B Corps or impact-driven startups.

- Advocate – Support policies promoting ethical finance.

- Educate Others – Spread awareness about social finance.

Conclusion: Finance with a Conscience

Social finance proves that money can be a force for good. By directing capital toward meaningful causes, investors can achieve profits with purpose—helping build a fairer, greener, and more inclusive economy.

Whether you’re an individual investor, a business leader, or a policymaker, embracing social finance can drive real change. The question is: Will you be part of the movement?

FAQs About Social Finance

Q: Is social finance only for wealthy investors?

A: No! Platforms like GoFundMe, Kiva, and Robinhood’s ESG options allow small-scale participation.

Q: Can social finance be profitable?

A: Yes! Many impact funds match or outperform traditional investments.

Q: How do I measure social impact?

A: Look for certifications like B Corp, GIIRS, or UN SDG alignment.

Q: What’s the difference between social finance and charity?

A: Charity is donations (no financial return), while social finance seeks both profit and impact.